Let’s be honest for a second. Living in France is a dream. The wine is affordable, the cheese is legendary, and the healthcare actually works. But as we step into 2026, there is one thing that keeps Expats awake at night—besides the French bureaucracy—it’s the taxes.

Specifically, capital gains taxes.

If you are a US or UK expat used to tax-efficient wrappers like Roth IRAs or ISAs, landing in the French fiscal system feels like hitting a brick wall. You want to invest. You want exposure to the S&P 500 because, frankly, you know that’s where the growth has been for the last decade. But you don’t want to hand over 30% of your gains to the French state via the “Flat Tax.”

Enter the Plan d’Epargne en Actions (PEA). It’s the closest thing France has to a tax haven. The catch? You are legally restricted to buying European stocks.

If you think that means you are stuck investing in French banks and German car manufacturers, I have good news. You aren’t. Through a brilliant bit of financial engineering, you can legally hold US stocks inside this tax-free wrapper.

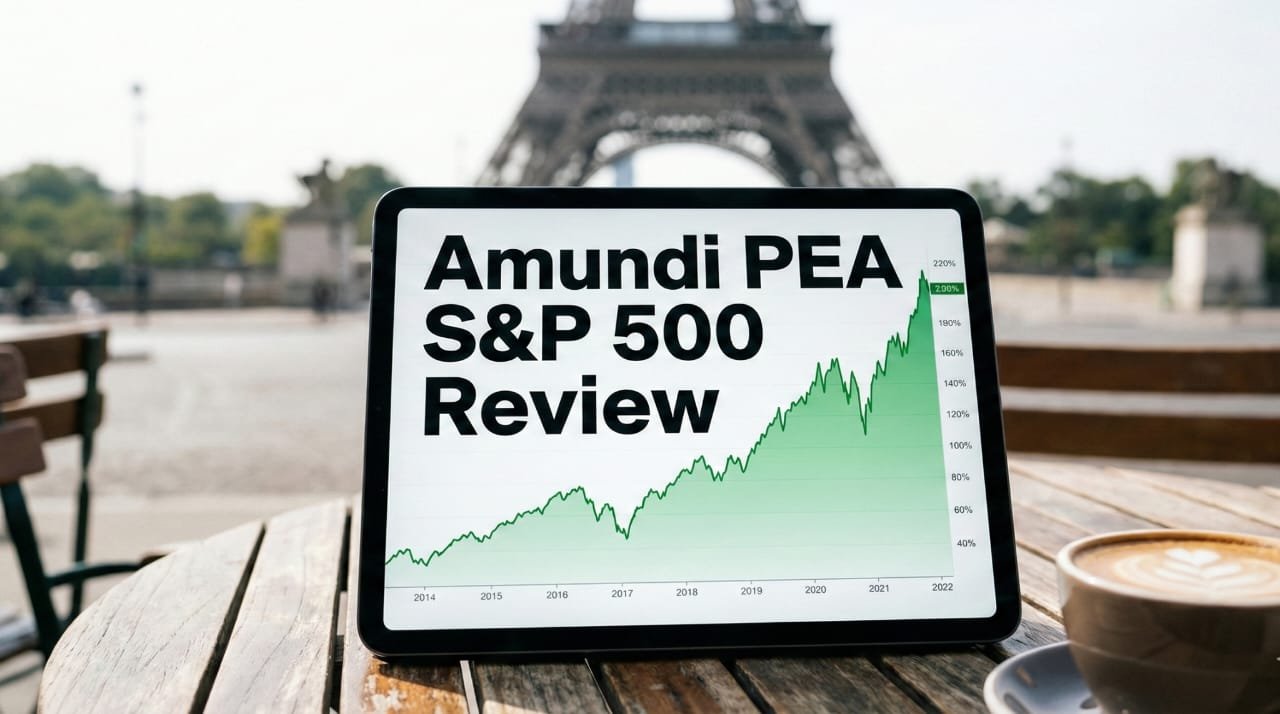

Today, we are looking at the heavyweight champion of this strategy: the Amundi PEA S&P 500. This ETF is widely considered the best option for Expats.

I have spent the last week tearing apart the latest technical data, the retrospective of 2025, and the post-merger details to give you the unvarnished truth for 2026. Is this still the best ETF for your French portfolio? Let’s find out.

Table of Contents

ToggleWhat is the Amundi PEA S&P 500?

If you walk into a French bakery and ask for a bagel, they will look at you like you’re crazy. The PEA is that bakery. It only serves European pastries (EU stocks).

So, how does the Amundi PEA S&P 500 (Ticker: PSP5) actually work to serve you Apple Microsoft, NVIDA shares?

The Magic of Synthetic Replication

The fund uses a mechanism called Synthetic Replication, specifically an “Unfunded Total Return Swap.”

Here is how it works in plain English:

The Physical Basket: When you buy shares of this ETF, your money is technically used to buy a basket of boring, compliant European stocks. Think LVMH, Sanofi, BNP Paribas, or Siemens. This satisfies the French regulator (AMF) because the fund physically holds at least 75% EEA assets.

The Swap: Amundi then signs a contract (a swap) with a major investment bank (like Société Générale or Goldman Sachs). In this contract, Amundi agrees to give the bank the performance of those European stocks. In exchange, the bank agrees to pay Amundi the exact performance of the S&P 500.

The result? You hold a fund that is legally European but performs exactly like the US market.

It sounds complex, but for you, the user experience is seamless. You buy the ETF, and if the S&P 500 goes up 1%, your account goes up 1% (minus a tiny fee).

The Technical Snapshot (2026 Data)

Before we get into the strategy, let’s look at the hard facts. As of early 2026, following Amundi’s complete absorption of Lyxor, the landscape has shifted slightly in favor of the investor. This report focuses on the historical Amundi PEA S&P 500, which remains the primary choice for most investors due to a recent competitive drop in fees.

| Metric | Data Point |

| Fund Name | Amundi PEA S&P 500 UCITS ETF Acc |

| ISIN Code | FR0011871128 |

| Ticker | PSP5 or PE500 (Check your broker) |

| Benchmark | S&P 500 Net Total Return (USD) |

| Total Expense Ratio (TER) | 0.12% (Lowered from 0.15%) |

| Replication Method | Synthetic (Unfunded Swap) |

| Dividend Policy | Accumulating (Reinvested) |

| PEA Eligible? | Yes (100%) |

| Currency | EUR (Unhedged) |

| Current Price | ~€51 (Affordable for monthly DCA) |

Warning: Since the merger, Amundi now runs two PEA S&P 500 ETFs. The one reviewed here (PSP5) is the former Lyxor fund, which is widely preferred for its massive liquidity. The “other” one (Ticker: PE500) is Amundi’s original fund. Both are good, but PSP5 is the heavyweight.

See More Article

Why "Net Total Return" Matters More Than You Think

You might see the benchmark listed as “S&P 500 Net Total Return” and yawn. It sounds like boring banker jargon. But pay attention, because this detail is crucial for your wallet.

The “Net Total Return” (NTR) index tracks the S&P 500 assuming that dividends are reinvested after the deduction of withholding taxes (usually 15% for international investors).

However, here is the secret sauce of synthetic ETFs.

The banks that act as counterparties often have special tax status. They can sometimes achieve better tax treatment on US dividends than the standard 15% withholding rate. Because the Amundi PEA S&P 500 tracks the NTR index, but the swap structure is so efficient, the fund often generates a little bit of “Tax Alpha.”

This allows the fund to perform exceptionally well against the index, effectively cancelling out the management fees. Don’t believe me? Let the numbers speak for themselves.

*Hypothetical performance based on historical data. Past performance is not a guarantee of future results.

Look at that difference. It represents the power of the US economy working for you versus letting your money sleep in a bank account.

The S&P 500 Index itself did roughly +106% over the same period. The Amundi PEA S&P 500 delivered +105%.

The difference is negligible. This proves that you are getting the full power of the US economy with almost zero leakage. Even after paying the fees, your returns are nearly identical to the actual index.

In the world of finance, where “fees eat returns,” this efficiency is a masterpiece. It shows that the synthetic replication isn’t just a legal trick to get into the PEA—it’s a performance booster.

Amundi vs. BNP Paribas: The Battle of the Titans

If you are hanging out on French finance forums or Reddit, you will see an endless debate: Amundi vs. BNP Paribas.

The primary competitor to our subject today is the BNP Paribas Easy S&P 500 UCITS ETF (Ticker: ESEE). Which one should you choose?

Let’s look at the data comparison.

Amundi PEA S&P 500

Ticker: PSP5BNP Paribas Easy

Ticker: ESEE*Free trades available on BoursoBank (Boursomarkets) for specific issuers.

1. Fees (The Cost of Doing Business)

Amundi (PSP5): 0.12% per year.

BNP Paribas (ESEE): Ranges from 0.13% to 0.15% (depending on the share class).

The Verdict: Historically, they were neck-and-neck. But Amundi has gained the edge here. With a Total Expense Ratio (TER) of just 0.12%, it is now one of the cheapest ways to access the US market from France. While BNP is excellent, in a game where every decimal point counts, Amundi takes the lead.

2. Assets Under Management (Size Matters)

Amundi: A heavyweight in the ETF world with massive liquidity on Euronext Paris.

BNP Paribas: Also a multi-billion euro giant.

Why this matters: Larger funds generally suggest higher liquidity and slightly better resilience against massive market shocks. Both of these funds are “too big to fail” in the context of ETFs, but Amundi’s recent consolidation of Lyxor assets has cemented its position as the go-to default for most investors.

3. The Real Decision Factor

Honestly? It often comes down to your broker.

Some French brokers have partnerships with specific issuers, which can save you transaction fees.

If you use BoursoBank (formerly Boursorama): Check their “Boursomarkets” list. Often, they offer 0€ transaction fees on specific ETFs (often iShares or Amundi/Lyxor). If Amundi is free to trade and BNP costs you €5 per trade, Amundi wins instantly.

If you are with BNP Paribas for your banking: Their in-house ESEE ETF might be cheaper to access.

Bottom Line: Both are “Gold Standard” ETFs. Don’t overthink this split.

If you already hold Amundi, keep it.

If you are starting fresh, check which one offers lower transaction fees on your specific platform. That €5 saving every month matters more than a 0.01% fee difference.

Why the "Acc" (Accumulating) Version is Mandatory

You will notice the fund name ends in “Acc”. This stands for Accumulating (or Capitalisation in French).

In France, inside a PEA, you generally want to avoid the “Dist” (Distributing) versions that pay out cash dividends.

How it works: When companies in the S&P 500 (like Microsoft or Coca-Cola) pay dividends, the ETF receives them. Instead of sending that cash to your account, the fund manager immediately uses it to buy more stocks within the fund.

Why this is brilliant for Expats:

Compound Interest: The money is reinvested instantly. You don’t have to wait to accumulate enough cash to buy another share. It’s automatic growth on top of growth.

No “Cash Drag”: You don’t have idle euros sitting in your account doing nothing while waiting for you to log in. Every cent is working 24/7.

Lazy Investing: You don’t have to lift a finger. The share price of the ETF simply grows faster over time compared to the price index alone.

Given that the goal of the PEA is long-term growth (5+ years to unlock the tax benefits), an Accumulating ETF is the only logical choice.

A Note on Currency Risk (Don't Panic)

This ETF is denominated in Euros, but the underlying assets (US stocks) are priced in Dollars. This fund is Unhedged.

What does this mean? This means you have two engines driving your returns:

The stock market performance (S&P 500).

The EUR/USD exchange rate.

If the S&P 500 stays flat, but the US Dollar gets stronger against the Euro (e.g., going from 1.10 to 1.05), your ETF value in Euros goes UP. Conversely, if the Euro gets stronger, your value might go down slightly, even if the stock market didn’t move.

Is this bad? Not really. As an Expat, you likely have financial ties to both currencies. Holding unhedged US assets provides a nice diversification.

Historically, the USD often strengthens during global crises, which can cushion your portfolio when stocks are falling. Just be aware that the impressive returns seen in 2025 include this currency fluctuation. It’s a feature, not a bug.

How to Buy It: A Step-by-Step Guide

Ready to pull the trigger? Here is how you execute this trade without looking like a rookie.

Step 1: Get the Right Code

Do not search by name. Names are messy. Search by ISIN or Ticker.

ISIN: FR0011871128

Ticker: PSP5 (or sometimes PE500, check your broker)

Step 2: Choose Your Broker

If you haven’t opened a PEA yet, avoid the traditional brick-and-mortar banks (Société Générale, BNP, LCL) unless they offer you a specific deal. Their fees are usually atrocious. Go for online brokers:

Fortuneo

BoursoBank (formerly Boursorama)

Bourse Direct

Step 3: Watch the Clock (Crucial!)

The ETF trades on the Paris stock exchange, but it tracks US stocks. The US market opens at 15:30 Paris time (CET).

09:00 to 15:30: The Market Makers in Paris are guessing the price based on futures. Spreads (the difference between buy and sell price) are okay, but not amazing.

15:30 to 17:30: This is the Golden Window. Both Paris and New York are open. Liquidity is highest, spreads are tightest. Try to buy during this time.

Step 4: Use a Limit Order

Never use a “Market Order.” With a Market Order, if there is a sudden glitch or a momentary drop in liquidity, you could end up paying way more than the fair price.

Tell the broker: “I am willing to pay €35.50 and not a cent more.” Set your Limit Order at the current “Ask” price (or slightly above if you want it filled instantly).

The Risks You Need to Know

would be a bad analyst if I didn’t mention the risks. This is a financial product, not a savings account.

Market Risk: If the US economy crashes, this ETF crashes. It is 100% equity.

Counterparty Risk: This is the synthetic part. If the swap bank goes bankrupt, there is a theoretical risk. However, UCITS regulations cap this exposure at 10%, and Amundi resets the swap daily to keep exposure near zero. Plus, you still own that physical basket of European stocks as collateral. It’s a very robust safety net.

Volatility: As seen in the data, the historical volatility typically hovers between 15% and 20%. That means the price bounces around a lot. This is for money you don’t need for at least 5 years.

Conclusion: Just Started

The French tax system is designed to be intimidating. It scares many Expats into leaving their cash in low-interest savings accounts (Livret A) or, worse, leaving it in a checking account.

The Amundi PEA S&P 500 is the key to breaking that paralysis and building wealth tax-free.

It is cheap (0.12%), it tracks the world’s best-performing index efficiently, and most importantly, it fits perfectly inside the tax-free PEA wrapper.

Is it perfect? No investment is. The currency swings can be annoying, and the synthetic structure feels weird at first. But the math is undeniable. Paying just 0.12% in fees to save 12.8% in taxes is a trade I will take every single day of the week.

So, open that PEA, punch in the ISIN, and let the US economy work for you while you enjoy your croissant in Paris.

People Also Ask (FAQ)

Is Amundi a good stock/company?

Amundi vs. Vanguard: Which is better for France?

What is Amundi PEG vs PEA?

• PEA (Plan d'Epargne en Actions): This is your personal freedom fund. You open it yourself, and you buy what you want (like this S&P 500 ETF).

• PEG (Plan d'Epargne Groupe): This is a company savings plan provided by your employer. While Amundi manages many PEG accounts, you usually cannot buy the specific S&P 500 ETF we discussed here inside a standard PEG.

What is the "ESG" version of this ETF?

Should you buy it? If you want to align your money with your values, yes. But for pure performance, the standard (non-screened) PSP5 ETF remains the most liquid and direct choice for most investors.