The Quick-Service Restaurant (QSR) sector, historically a bastion of resilience, is undergoing an Unstoppable structural transformation in 2025. This year is marked by a massive wave of hamburger chain restaurant closures across North America and Europe, signifying a harsh market correction driven by persistent inflation, surging operational expenditures, and decisive shifts in consumer spending. This is no longer routine portfolio maintenance; it is a profound industry restructuring. Franchisees are facing unprecedented pressure, leading to strategic bankruptcies and significant store count reductions for even the most established brands. This data-driven, analytical report provides a comprehensive breakdown of the core economic drivers and necessary strategic pivots defining this acute market Crisis.

Table of Contents

ToggleThe Current Market Reality: Why the Surge in Hamburger Chain Restaurant Closures?

The accelerated rate of permanent shutdowns confirms a fundamental breakdown of the traditional QSR model’s profitability levers. The resulting hamburger chain restaurant closures reflect a systemic inability to reconcile rapidly escalating fixed and variable costs with a consumer base that is increasingly price-fatigued.

Tally of Major Chain Closures in Q4 2024 and Q1 2025 (US & Europe)

Early 2025 data shows a sharp acceleration in targeted closures, often concentrated in underperforming urban and high-rent suburban areas. In the US Market, several major chains have announced significant ‘system optimization’ plans. For example, a leading national burger chain confirmed plans to shutter around 300 U.S. stores between late 2025 and 2026, citing a sharp decline in same-store sales (e.g., a 4.7% drop in Q3 2025). This is often due to franchisee distress and failure to meet debt obligations. The European Market, while structurally less prone to mass franchisee bankruptcies, is seeing a steady attrition of stores due to enduring high energy costs, restrictive labor laws, and a sluggish post-inflation economic recovery, compounding the reasons for fast-food burger joint shutdowns.

The Enduring Impact of Macroeconomic Headwinds on QSR Margins

The global economic climate—characterized by stubbornly high interest rates and moderated consumer confidence—continues to exert intense pressure on QSR operating margins, which are typically thin (3-5%). The prolonged period of food-away-from-home inflation has effectively erased the low-cost advantage of fast food. Lower-income consumers, in particular, are pulling back spending or shifting entirely to groceries (food-at-home), directly reducing transaction volume and pushing many locations past their breakeven point, leading to mandatory quick service restaurant challenges like store rationalization.

The Collapse of Value Proposition: Inflation and the Death of the Dollar Menu

The single greatest driver of closures in the core hamburger chain restaurant closures segment is the death of the true value proposition. Persistent inflation in core ingredients (especially ground beef and packaging) means offering a traditional ‘value menu’ item is no longer sustainable. Menu prices across the sector have jumped, sometimes exceeding 30% since 2020. This transformation eliminates the price gap between QSR and fast-casual dining, forcing customers to trade up for perceived quality or trade down to cheaper alternatives, leaving mid-tier burger joints highly vulnerable.

Core Drivers of Fast-food burger joint shutdowns:

The core economic vulnerability stems from the inability of operators to raise prices sufficiently to cover rapidly escalating, non-negotiable operational costs.

Analyzing the Labor Cost Crisis: Automation and the Minimum Wage Effect

Labor remains the single largest operating expense for QSRs. The implementation of higher minimum wages across key US states (like California’s significant raise) has triggered a labor cost crisis in 2025. While necessary for workers, these hikes necessitate an immediate increase in pricing or, more commonly, a drastic reduction in staff hours and, critically, a heightened push toward automation. Many of the current hamburger chain restaurant closures are strategic decisions to eliminate high-labor, low-volume stores that can no longer absorb the new wage baseline.

Supply Chain Volatility and Commodity Price Pressure

Despite some easing, supply chain volatility and elevated commodity prices remain a critical headwind. For burger chains, the price of beef, cooking oil, and logistics (transportation) has seen unpredictable spikes, making accurate cost forecasting difficult. According to industry reports, over 90% of restaurant operators experienced food cost increases in 2025, forcing margin compression and increasing the financial risk for franchise operators who are locked into long-term leases and royalty payments.

Franchisee Distress and The Leverage Trap

The most visible manifestation of this crisis is franchisee distress. Many multi-unit operators expanded aggressively during periods of low interest rates and easily accessible credit. With revenue stabilizing or declining and debt service costs soaring in the current high-interest environment, many franchisees are caught in a leverage trap. Bankruptcy filings are becoming a common mechanism to shed chronically underperforming locations and restructure unsustainable debt loads. This highlights the risk inherent in the heavily leveraged, high-volume model that underpins many burger chains.

Shifting Consumer Behavior and Disruptive Market Competition

The landscape is being radically reshaped by evolving consumer demands for quality and convenience, as well as intensified competition.

The Great Trade-Off: Consumers Prioritize Quality or Extreme Value

The 2025 consumer is making a definitive choice: either pay a premium for perceived quality (Fast-Casual) or demand extreme, non-negotiable value (deep-discount grocery or select value-focused QSRs). The mid-market burger chain that offers neither the lowest price nor the highest quality is being squeezed out. This trade-off is directly responsible for traffic declines and the subsequent strategic need for hamburger chain restaurant closures.

The Ascendancy of Fast-Casual: Redefining the Burger Category

Fast-casual brands (e.g., Five Guys, Shake Shack) continue to seize market share by successfully positioning their product as a superior, customizable experience that justifies a $2-$5 higher price point. This sector’s success forces traditional QSRs to invest heavily in ingredient quality and store remodels to compete—a capital expense many struggling franchisees cannot afford. The failure to evolve quality standards is fueling the broader fast food industry crisis.

Digital Platforms and Operational Friction

The reliance on digital ordering, delivery (off-premises dining), and loyalty apps is now mandatory. While digital sales often represent over 30% of total revenue for some chains, third-party delivery commissions (often 20-30%) destroy unit economics for already thin-margin products. Furthermore, integrating multiple digital platforms—from mobile apps to in-store kiosks—creates operational friction and requires significant capital expenditure, exacerbating the challenges for legacy operators.

Regional Analysis of Hamburger Chain Restaurant Closures: US vs. European Trends

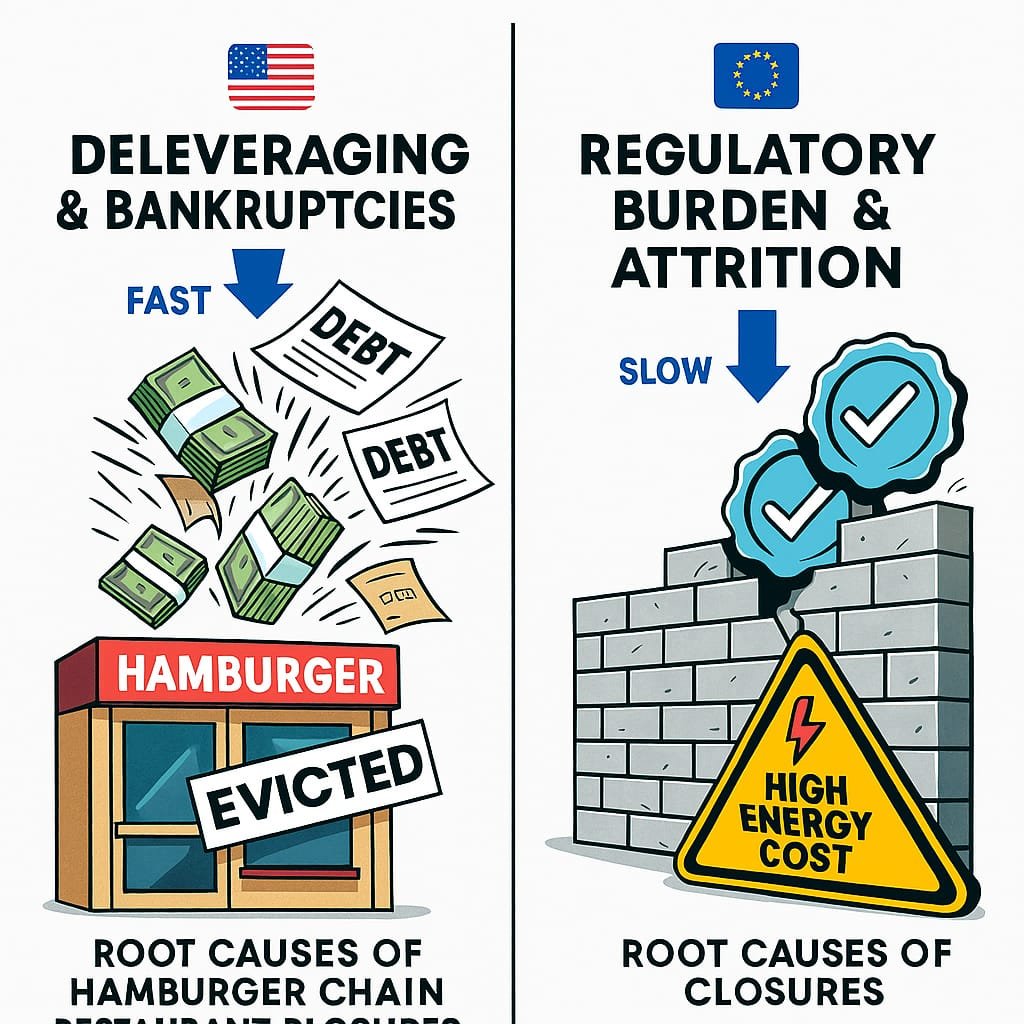

While facing similar cost pressures, US and European markets exhibit different closure dynamics due to structural and regulatory differences.

US Market Dynamics: Deleveraging and System Optimization

The US market is defined by over-saturation and deleveraging. The closures here are often abrupt and large-scale, driven by franchisee Chapter 11 filings or corporate-mandated ‘system optimization.’ For instance, the planned closure of hundreds of U.S. stores by one leading chain is a textbook example of shedding chronically underperforming or “brand-damaging” locations to reallocate capital to higher-performing units, thus strengthening the remaining system.

European Market Dynamics: Regulatory Burden and Post-Inflation Stagnation

The European market experiences slower growth but also less volatile mass closures. Challenges are primarily rooted in rigid labor laws, high VAT rates, and high operating costs (especially energy and stricter environmental/packaging regulations). The slower pace of economic recovery in several major EU economies has maintained consumer cautiousness, resulting in sustained, lower traffic and a gradual, profit-driven attrition of fast-food burger joint shutdowns.

Case Studies in Strategic Retreat (Mid-2025 Examples)

The announced closure of around 300 U.S. stores by one prominent chain, and the strategic trimming of its high-street portfolio by a UK-based burger chain, vividly illustrate the trend. In both cases, the closures are a response to a sharp decline in same-restaurant sales and rising food/labor costs, proving that even globally recognized brands are not immune to the severe profitability squeeze of the mid-2020s.

Strategies for Survival: Beyond the Hamburger Chain Restaurant Closures Crisis

Chains intent on long-term survival must fundamentally redesign their operational and physical models, shifting focus from volume expansion to unit efficiency and technological leverage.

The Pivot to Optimized Footprints: Drive-Thru Dominance and Ghost Kitchens

The future QSR model is moving away from debt-heavy, large-format dining rooms. Drive-Thru-Only and Dual-Lane Drive-Thru models, optimized for speed and off-premises dining, significantly reduce expensive real estate and labor overhead. The strategic use of Ghost Kitchens allows brands to serve dense urban delivery zones without the high fixed costs of street-level retail, providing a flexible buffer against future quick service restaurant challenges.

Technology and Hyper-Automation: The Necessity of AI in QSR

Automation is no longer optional; it is the essential countermeasure to the labor cost crisis. 2025 is seeing heavy investment in AI-powered tools: self-ordering kiosks, dynamic menu boards, predictive inventory management, and even back-of-house robotics (e.g., automated fry stations). This technology aims to increase transactional speed and accuracy while reducing dependence on a volatile and expensive human labor force, ensuring better margin control.

Streamlining the Menu: High-Margin, Low-Complexity Operations

Successful QSRs are engaging in rigorous menu rationalization. This means shedding low-volume, low-margin, or high-complexity items that slow down the kitchen and increase waste. The focus is on a limited, high-quality, and high-margin core offering that maximizes throughput and consistency. This strategy directly combats the profit compression that has fueled the majority of recent hamburger chain restaurant closures.

Final Forecast:

The brutal correction seen in the 2024-2025 period is purging the QSR industry of inefficiency and over-leverage. The resulting market will be leaner, more technologically advanced, and focused on operational mastery.

Key Takeaways for Investors and Prospective Franchisees

For investors, the winners will be those chains demonstrating a strong balance sheet, high digital sales penetration, and a clear, capital-efficient strategy for automation. Prospective franchisees must now assume a higher risk premium and should only invest in smaller, drive-thru-focused units with favorable lease terms and franchisor support (particularly for supply chain pricing) to withstand future economic volatility.

The Forecast: What 2026 and Beyond Hold for the Burger Industry

2026-2027 is forecasted to be a period of stabilization and strategic growth for the surviving operators. While the overall global fast-food market is projected to grow (at an estimated 5.3% CAGR through 2035), this growth will disproportionately benefit highly optimized, technology-enabled, and fast-casual brands. Menu prices will remain elevated, and the industry will be fundamentally redefined by a focus on hyper-efficiency and the ability to seamlessly integrate the digital and physical customer journey.

Call-to-Action (CTA): Join the Conversation

The hamburger chain restaurant closures crisis is reshaping how we dine. What strategic moves do you believe will define the next generation of QSR success? Share your insights and predictions for the 2026 market landscape below.